Interview with Bancore Group

The “dream”

“Our ambition is to enable everyone in Africa, and the rest of the developing world, to become a part of the global economy. At Bancore Group we issue people with a virtual prepaid card in three minutes. All they need is an ordinary mobile phone to pay their bills, to make payments, to send money to someone else and to draw cash without a physical card – also in areas without ATMs or bank branches. Everyone should be able to do the things that we in Europe take for granted, including, for example, the ability to have an iTunes account in a recognised and accepted currency. We are a business with a purpose, to include everybody in the global financial system.”

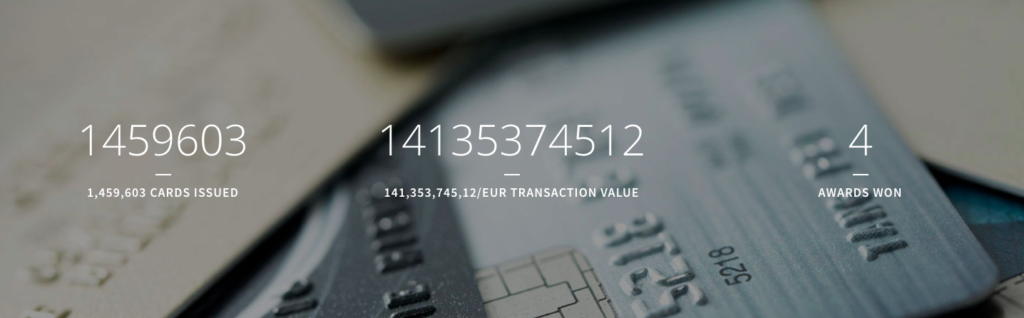

Current status

The Bancore Group, which has 2.5 million virtual cards worldwide, aspires to grow from fintech status to the world’s largest bank – the ‘bank of payments’ across all money distribution channels, including global remittances. “Currently we are partnering with Small World to offer instant settlement on remittances in Nigeria – with plans to roll this out to the rest of Africa.”

“In much of the developing world, and particularly in Africa, bank branches and ATMs are only available in major cities – a good 6 to 10 hour journey for many people. In these areas agency banking offers a real lifeline. Bancore has a network of 45,000 agents that enable people to draw money without a physical card.”

Challenges in the geographical areas

“Understanding and staying power are key requirements for working in some emerging markets. Fintechs require investment to develop, test and roll out their solutions and products. However, it requires investors that recognise the potential and have the willingness and the patience to invest in these markets, as it would typically take longer to see a return on investment. There is still work to be done to raise better understanding of the market mechanisms and cultural differences.”

Emerging markets also come with a variety of technical and infrastructural challenges, which means that while mobile access may be high, networks are not always large enough to cover the need for bandwidth and data connectivity can sometimes be down for days.

“We do believe that helping people out of poverty and enabling them to be part of whole financial ecosystem ultimately has the potential of making the world a better place to live.”

About the Nordic effort

The Nordic region, with limited natural resources compared with the rest of the world, need to be smarter in other fields of expertise. The Nordics are good at developing solutions that can be scaled and used for different purposes. Bancore’s prepaid card was originally developed for Europe as a tool for parents to provide their kids with funds. This is the same platform that is now being used to bring access to financial services in emerging markets.

The Nordics have historically been sending considerable monetary contributions to support emerging countries. However, companies in this part of the world also have a responsibility to make the world a better place. Instead of only sending money, there is an obligation to educate, help with development and create sustainable employment. Bancore is offering financial services in order to give the power back to the people and ensuring that they become part of the world economy and take control of their own money. Fintechs are in a strong position to fulfil this vision because of a lack of trust in governments and banks.

The Financial Inclusion Summit takes place in Oslo, Norway, on 28 March 2019. To find out more or request an invitation, visit: https://financial-inclusion.com/#register

Follow us on @FinIncSummit #fintechforall