Interview with Diwala

The “dream” – how it started

With a passion for impact, Diwala met and joined forces at a hackathon hosted by Innovation Norway and UN women in 2017. After winning the hackathon, the Diwala team established the mission to give youths and displaced people around the world the means to empower themselves. With a skilled team with experience from both tech, design and the humanitarian sector they pushed forward and got accepted into both the Factory and Katapult Impact Accelerators. A year and half year later, Diwala is implementing the platform in Uganda with established partners and clients.

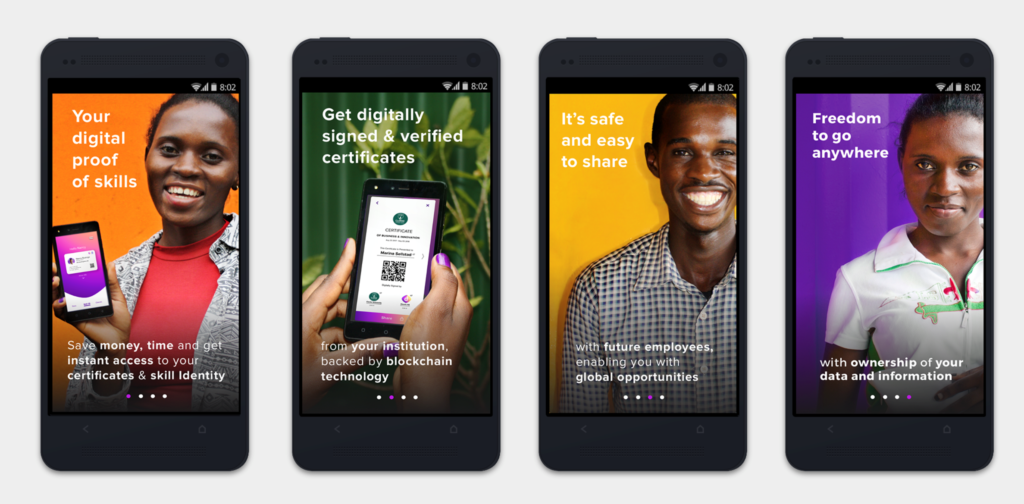

Diwala is a digital economy platform powered by blockchain

Diwala is building an ecosystem of trust, by issuing skill identities for youth and displaced communities. By enabling organizations to safely issue digital identities and verified credentials, the platform will create global opportunities for youth, as well as combating identity and certification fraud worldwide.

Through the platform and application, Diwala aims to not only provide self-sovereign identities to the youth of Uganda and Kenya, but also to empower them with ownership of their data. Moreover, the platform will create an of ecosystem where students, schools, and organizations will have transparent, authentic and digitally-trusted information to rely on.

Challenges in the geographical areas of influence

Today, displaced individuals and people in emerging markets are challenged by high costs and slow manual processes to verify the authenticity of their skills, identity and credentials. As a result, these individuals have to deal with tedious and out-dated credentialing processes, and are in some cases forced to repeat years of education. This process is not only costly for the students, but leads to both loss of productivity and inflated unemployment.

Diwala’s current focus is to implement the platform in Uganda, where people are challenged by lack of identity and certificate inconsistencies. This harms Ugandan organizations reputation and negatively impact the organization’s’ overall performance, as well as the infrastructure growth of the country. The Uganda education authorities have until now had limited resources in providing certificates that are unquestionably authentic, which has provided ample opportunities for others to exploit this gap in educational authentication.

Cooperation and partnerships

Diwala is currently executing pilots regularly in Uganda, optimizing the features and security of the core platform in collaboration with Clarke University and Fontes Foundation. In addition, implementation pilots are taking place in Kenya in with Lumen Labs & WIESER, where the focus is especially looking into how digitally verifiable certificates can be issued in rural settings where offline solutions are needed.

Diwala has partnered with Esusu, a digital tool and service designed to help people improve their financial resiliency and establish robust financial identities. The partnership has been established to empower individuals with digital ownership of both assets and identity.

Diwala was also just accepted into the Lighthouse Development Program, initiated by Mastercard and NFT Ventures.

Successes

In approximately 1,5 year, Diwala has gained funding, established a company and developed a Beta version of the Diwala platform and mobile application. In December 2018, Diwala recently issued the first set of skill-identities to students and administrators in Uganda. These are the first ever digitally verified certificates backed by decentralized identity and blockchain in Africa. Diwala also recently received an honorable mention in Newsweek’s Blockchain Impact Award 2019.

The Nordic effort

Thinking local, acting global. Molded by cross sector partnerships to maximise independence and dignity for people.

The Financial Inclusion Summit takes place in Oslo, Norway, on 28 March 2019. To find out more or request an invitation, visit: https://financial-inclusion.com/#register

Follow us on @FinIncSummit #fintechforall